Toyota and other Japanese automakers are facing their biggest sales decline in China in years.

Analysts warn that the slow launch of electric vehicles by Japanese brands is the leading reason that threatens their future in the Chinese auto market.

The price war sparked by Elon Musk’s Tesla (6th price cut in 2023) has hit automakers at a time when passenger car sales in China are falling due to growth.

Toyota is gradually losing market share in China.

However, the decline is especially severe for Japanese brands.

The sharp drop in sales poses a challenge to Toyota, the world’s largest automaker, which has been slower than rivals to shift toward electric cars.

The Japanese automaker argues that not every country can accommodate electric vehicles due to electricity and affordability constraints, and has decided to focus on its hybrid models.

“There are clear signals that Toyota is in a dangerous position,” said Tang Jin, a senior research officer at Mizuho Bank in Tokyo.

`Last year was a turning point for China as the new energy vehicle market accounted for 25%. Toyota was the best-selling brand among Japanese brands, but as overall demand for gasoline-powered vehicles decreased, it

Recently, Toyota launched two new models from its electric bZ line at the Shanghai auto show.

bZ3 – Toyota’s newly launched pure electric sedan.

In March, Toyota’s annual sales in China were down 19%, Honda’s were down 19% and Nissan’s sales were down 25%.

“The surge in shopping growth has slowed in China,” a Toyota executive said at a press conference in February.

Before the pandemic, Toyota had invested heavily in China to take on Volkswagen, which entered the market 37 years ago through local joint ventures.

In 2016, Volkswagen sold 3 million cars, 2.5 times more than Toyota, but the sales gap between the two automakers narrowed to only 360,000 cars last year.

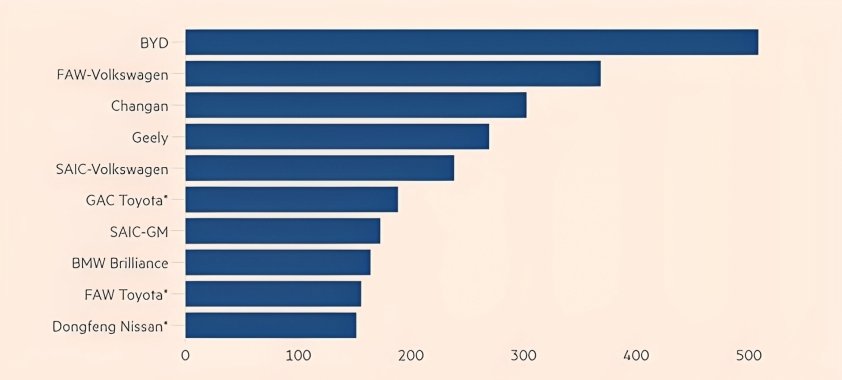

Sales of car manufacturers in China in the first quarter of 2023

Although slow, Toyota has tried to accelerate its electric vehicle transition in China.

In 2019, the Japanese corporation signed an agreement with Chinese battery giant CATL to develop batteries for electric vehicles.

The bZ3 is expected to be produced at a factory in Tianjin, using a $1.2 billion production line specializing in electric and hybrid vehicles.

The company is also putting its Lexus premium brand at the forefront of electrification, with all models expected to be pure electric by 2035.

Analysts say one of the key challenges for Japanese automakers is whether they can maintain a balance between prices and profitability as both Tesla and BYD continue to

According to Jing Yang, director of Shanghai-based Fitch Ratings, “Among electric vehicle brands, only Tesla and BYD are profitable in China at the moment.